Nvidia has surpassed Microsoft and Apple to become the world’s most valuable company, reaching a market cap of $3.34 trillion (£2.63 trillion) after its share price hit an all-time high. The stock closed at nearly $136, up 3.5%. This surge is driven by Nvidia’s leadership in AI chip production, a crucial component in the tech sector’s growth.

Chris Penrose, Nvidia’s global head of telco business development, emphasised generative AI’s transformative impact on businesses. Wedbush Securities analysts predict a race to a $4 trillion market cap among Nvidia, Apple, and Microsoft. Despite potential gains, some analysts expressed caution due to increasing competition.

Rapid Growth

Nvidia’s growth has been spectacular. Eight years ago, its stock was worth less than 1% of its current price. Initially competing with AMD in graphics cards, Nvidia capitalised on the demand for AI chips, particularly for training models like OpenAI’s ChatGPT. The 2020 Bitcoin mining boom also boosted its graphics card sales.

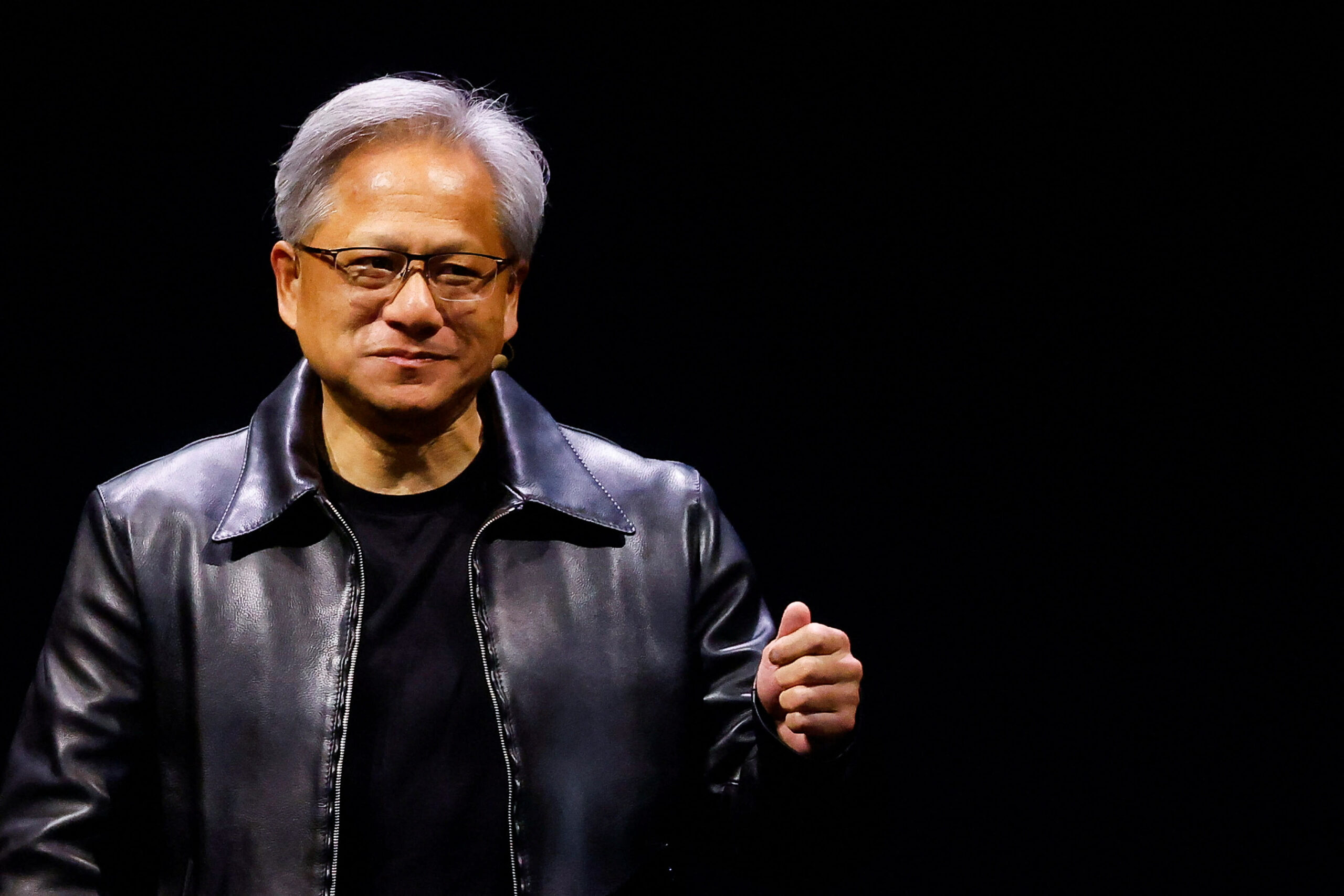

At the helm of Nvidia’s success is CEO Jensen Huang, a figure who has achieved celebrity status, particularly in Taiwan. His high profile has earned him the nickname ‘Taylor Swift of tech’ from meta CEO Mark Zuckerberg, a testament to his influence and the company’s prominence.

Competitive Landscape

Tech giants like Microsoft, Alphabet (Google’s parent), Meta, and Apple are fierce competitors in AI development. This competition benefits Nvidia, which dominates the AI chip market. Nvidia’s financial performance has consistently exceeded expectations. Quilter Cheviot analyst Ben Barringer noted that Nvidia “once again cleared a very high hurdle” with solid demand in May.

Future Prospects

However, some analysts remain cautious. Barclays’ Sandeep Gupta questioned Nvidia’s ability to maintain its market share amid growing competition and how its customers will monetise AI software.

The future of Nvidia is intricately tied to its ability to innovate and stay ahead in the rapidly evolving tech landscape. Its continued success hinges on its capacity to maintain its competitive edge, a challenge it is poised to tackle with its proven track record and market dominance.